You’re a Duuo Partner! Now what?

Now that you’ve registered your building(s) with us, it’s time to let your tenants know about it. Make Duuo part of your tenant experience to ensure they always get the right coverage (and the right discount!).

1. Share our link!

Click the button below to copy our quoting link. Directly share it with your tenants or embed it into important rental materials.

2. Include us in your rental materials

Here’s some copy you can slip right into your existing rental materials and other important tenant resources:

We’ve selected Duuo as our tenant insurance partner, which allows our tenants access to a preferred rate on coverage. To learn more click HERE. Don’t forget to look out for the “Duuo Partner” tag when purchasing!

By the way! If you email us your digital rental or lease agreement clearly highlighting our partnership*, we’ll send you a $50** Amazon gift card.

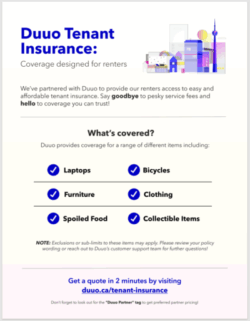

3. Share our digital handouts

Download these handouts and include them as an attachment to your tenants. If physical copies are more your thing, simply request them from your partner success specialist.

Additional Resources

Share our policy summary with your tenants or add our logo to your rental materials and webpages.